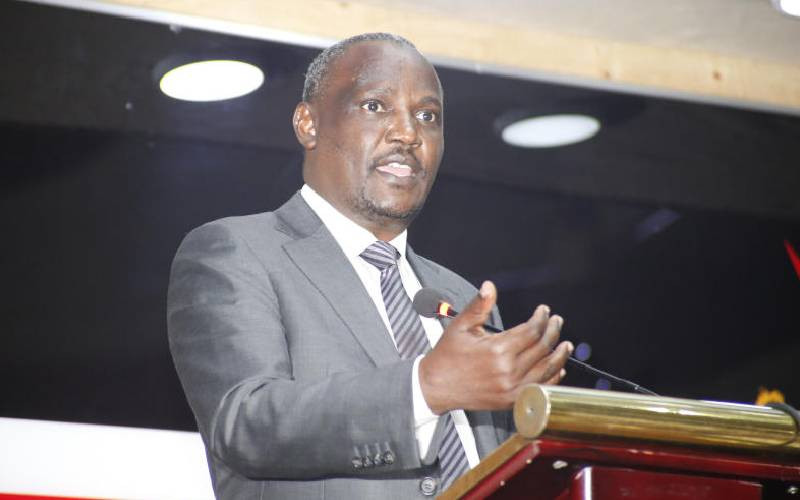

National Treasury Cabinet SecretaryJohn Mbadi during the launch of 2025 Economic Survey at the KICC, Nairobi, on May 6, 2025.[Kanyiri Wahito, Standard]

When former Kenya Association of Manufacturers chairman Rajan Shah posed a question on the numerous levies and fees imposed by State agencies, the underwhelming response from National Treasury Principal Secretary Chris Kiptoo was a proposal to have a meeting that could iron out the issues.

Shah also sought to understand why there are countless State agencies yet the government has always advocated for a leaner administration.

He noted that these agencies impose levies that choke businesses, some cases being double taxation, citing the National Environmental Management Authority (Nema) Extended Producer Responsibility (EPR) regulations.

“What we do not see is the speed in which this (shrinking of the government) is happening. We are not seeing some of this consolidation of agencies.

“Instead, we are seeing agencies levying fees and levies to generate revenue for them thus increasing the cost of doing business,” he said during a meeting between the PS and Kenya Private Sector Alliance.

As a result, he said, the cost of doing business is going up.

“They (agencies) need to find other means to generate revenue which they are not getting from the government coffers. We are double taxing businesses.”

The response from the PS reflects where the government’s focus is when it comes to raising revenue.

With a ‘softer’ Finance Bill, 2025 on the table to avoid a repeat of last year’s protests that led to the scrapping of Finance Bill, 2024, President William Ruto’s administration has placed a special focus on non-tax revenue.

“There are people who receive services from the government, like passport applications, but may not be in the tax bracket especially in the informal sector,” noted the PS during the meeting.

While this presents the government with a low-hanging fruit to raise the much-needed revenue, it is a concern for businesses who have been hoping for a streamlined tax system.

Data from the National Treasury shows collections from value added tax (VAT), a pain point for businesses, contracted by 2.1 per cent as at March 2025 when compared to the same period in 2024, while the category of ‘other revenue’ grew by 60.8 per cent.

These amounts rose from Sh97.9 billion in March 2024 to Sh157.3 billion in March 2025.

This data shared by the PS also shows a contracted growth of 16.2 per cent in appropriation-in-aid, where ministries, departments and agencies fall (MDAs), as the amount dropped to Sh278.8 billion from Sh332.7 billion.

As such, the government was forced to revise its revenue projections for the year ending June 30, 2025, to Sh3 trillion from an earlier amount of Sh3.1 trillion.

“Total revenues amounted to Sh2 trillion against a target of Sh2.1 trillion resulting to an underperformance of Sh161.9 billion largely in ordinary revenue of Sh142.8 billion,” the data reads.

“Ordinary revenues grew by 7.0 per cent with all taxes recording growth rates except VAT.”

The drop in VAT, the PS explained is informed by offsets by businesses who are owed refunds by the taxman.

“That does not meant VAT did not grow, it is just that there were offsets. We were able to give them (businesses) back some amounts to offset so that the money that came to the exchequer is actually lower than what we collected,” Kiptoo said.

“But the business community is saying it is not enough and we have agreed it is an area we need to work on because liquidity held is also not good for business.”

National Treasury says the government is exploring non-tax revenue measures to reduce MDAs’ dependence on exchequer revenue.

This will ensure that MDAs’ appropriation-in-aid is sufficient to cover their expenditures without relying on the exchequer.

“The government will ensure that proposed charges, levies, and fees are reasonable, avoiding undue burden on Kenyans and maintaining effective service delivery,” reads the policy statement in part.

The PS explained that the government does not want to focus on raising more revenue by increasing the taxes.

“Instead, we want to focus on areas that we ensure we have fairness and equity in the tax system,” he said.

He said the focus of the Finance Bill is on tax administration by the Kenya Revenue Authority.

“We don’t expect much yield from what we have taken to Parliament but we expect the accumulation of past reforms and tax measures are sufficient enough to finance the budget,” Kiptoo said.

Nema’s EPR regulations—a cost implication not only on registration but also compliance for manufacturers and importers—is the latest fees imposed by a State agency.

The regulations seek to make brand owners, manufacturers, producers and importers of products responsible for the after-sale waste associated with their products, imposing a fee on the packaging materials used.

This in turn threatens to increase the price of basic commodities such as bread and diapers.

National Treasury Cabinet SecretaryJohn Mbadi during the launch of 2025 Economic Survey at the KICC, Nairobi, on May 6, 2025.

[Kanyiri Wahito, Standard]

When former Kenya Association of Manufacturers chairman Rajan Shah posed a question on the numerous levies and fees imposed by State agencies, the underwhelming response from National Treasury Principal Secretary Chris Kiptoo was a proposal to have a meeting that could iron out the issues.

Shah also sought to understand why there are countless State agencies yet the government has always advocated for a leaner administration.

He noted that these agencies impose levies that choke businesses, some cases being double taxation, citing the National Environmental Management Authority (Nema) Extended Producer Responsibility (EPR) regulations.

“What we do not see is the speed in which this (shrinking of the government) is happening. We are not seeing some of this consolidation of agencies.

“Instead, we are seeing agencies levying fees and levies to generate revenue for them thus increasing the cost of doing business,” he said during a meeting between the PS and Kenya Private Sector Alliance.

As a result, he said, the cost of doing business is going up.

“They (agencies) need to find other means to generate revenue which they are not getting from the government coffers. We are double taxing businesses.”

The response from the PS reflects where the government’s focus is when it comes to raising revenue.

With a ‘softer’ Finance Bill, 2025 on the table to avoid a repeat of last year’s protests that led to the scrapping of Finance Bill, 2024, President William Ruto’s administration has placed a special focus on non-tax revenue.

“There are people who receive services from the government, like passport applications, but may not be in the tax bracket especially in the informal sector,” noted the PS during the meeting.

While this presents the government with a low-hanging fruit to raise the much-needed revenue, it is a concern for businesses who have been hoping for a streamlined tax system.

Data from the National Treasury shows collections from value added tax (VAT), a pain point for businesses, contracted by 2.1 per cent as at March 2025 when compared to the same period in 2024, while the category of ‘other revenue’ grew by 60.8 per cent.

These amounts rose from Sh97.9 billion in March 2024 to Sh157.3 billion in March 2025.

Stay informed. Subscribe to our newsletter

This data shared by the PS also shows a contracted growth of 16.2 per cent in appropriation-in-aid, where ministries, departments and agencies fall (MDAs), as the amount dropped to Sh278.8 billion from Sh332.7 billion.

As such, the government was forced to revise its revenue projections for the year ending June 30, 2025, to Sh3 trillion from an earlier amount of Sh3.1 trillion.

“Total revenues amounted to Sh2 trillion against a target of Sh2.1 trillion resulting to an underperformance of Sh161.9 billion largely in ordinary revenue of Sh142.8 billion,” the data reads.

“Ordinary revenues grew by 7.0 per cent with all taxes recording growth rates except VAT.”

The drop in VAT, the PS explained is informed by offsets by businesses who are owed refunds by the taxman.

“That does not meant VAT did not grow, it is just that there were offsets. We were able to give them (businesses) back some amounts to offset so that the money that came to the exchequer is actually lower than what we collected,” Kiptoo said.

“But the business community is saying it is not enough and we have agreed it is an area we need to work on because liquidity held is also not good for business.”

National Treasury says the government is exploring non-tax revenue measures to reduce MDAs’ dependence on exchequer revenue.

This will ensure that MDAs’ appropriation-in-aid is sufficient to cover their expenditures without relying on the exchequer.

“The government will ensure that proposed charges, levies, and fees are reasonable, avoiding undue burden on Kenyans and maintaining effective service delivery,” reads the policy statement in part.

The PS explained that the government does not want to focus on raising more revenue by increasing the taxes.

“Instead, we want to focus on areas that we ensure we have fairness and equity in the tax system,” he said.

He said the focus of the Finance Bill is on tax administration by the Kenya Revenue Authority.

“We don’t expect much yield from what we have taken to Parliament but we expect the accumulation of past reforms and tax measures are sufficient enough to finance the budget,” Kiptoo said.

Nema’s EPR regulations—a cost implication not only on registration but also compliance for manufacturers and importers—is the latest fees imposed by a State agency.

The regulations seek to make brand owners, manufacturers, producers and importers of products responsible for the after-sale waste associated with their products, imposing a fee on the packaging materials used.

This in turn threatens to increase the price of basic commodities such as bread and diapers.

By Graham Kajilwa