Kenya has moved to repair its dented credibility in fighting illicit financial flows after it was greylisted by a global money laundering and terrorism financing watchdog.

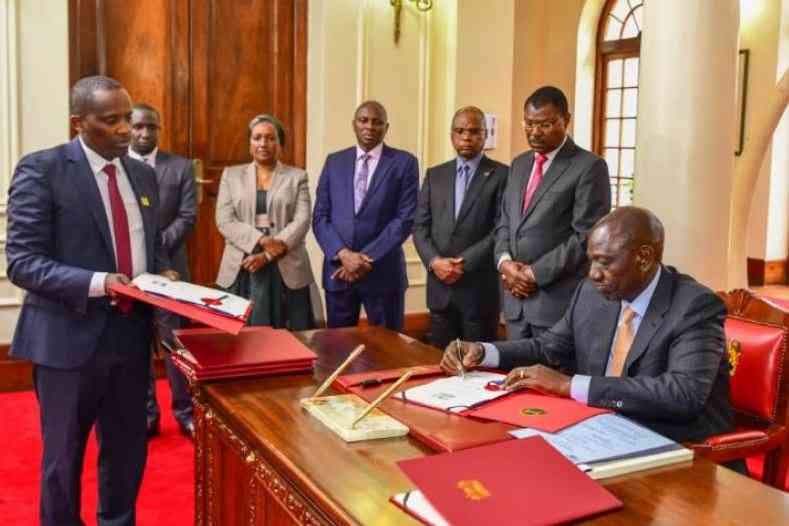

President William Ruto yesterday assented to the Anti-Money Laundering and Combating of Terrorism Financing Laws (Amendment) Bill, 2025, which is expected to strengthen Kenya’s framework for tackling money laundering, terrorism financing and proliferation financing.

Kenya was in February last year put on Finance Action Task Force’s (FATF) grey list after it failed to meet required threshold in its anti-money laundering and counter terrorism oversight, which made the country vulnerable to illicit financial flows.

Greylisting has far-reaching consequences, including local firms being unable to access international finance and trade opportunities, as well as losing foreign direct investments from global investors wary of pumping money into greylisted countries.

The enactment of the new law, State House said in a statement, represents a decisive step in bolstering the country’s financial system against illicit financial flows.

“The amended law seals long-standing loopholes that have enabled the misuse of property transactions and shell companies for illegal financial activities,” said the statement.

“These legal reforms reaffirm Kenya’s standing as a leader in financial integrity and enhance the country’s credibility in the global regulatory regime.”

Initially passed on April 16, 2025, the Bill was returned to Parliament by President Ruto with reservations. It was passed a second time by the National Assembly on June 3, 2025, with amendments that fully addressed the President’s concerns.

Ten Acts of Parliament have been amended to address technical compliance deficiencies flagged by the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) and the Financial Action Task Force (FATF).

The amended laws are: The Proceeds of Crime and Anti-Money Laundering Act (Cap. 59A); the Prevention of Terrorism Act (Cap. 59B); the Betting, Lotteries and Gaming Act (Cap. 131); the Retirement Benefits Act (Cap. 197); the Mining Act (Cap. 306); the Sacco Societies Act (Cap. 490B); the Accountants Act (Cap. 531); the Estate Agents Act (Cap. 533); the Certified Public Secretaries of Kenya Act (Cap. 534); and the Public Benefits Organizations Act (No. 18 of 2013).

The introduction of enhanced regulatory clarity and oversight in sectors such as real estate and mining is expected to boost investor confidence and attract foreign direct investment.

President Ruto also signed into law the Insurance Professionals Bill, which establishes a comprehensive legal framework to regulate the insurance industry, aimed at improving service standards, strengthening accountability and addressing professional misconduct in the sector.

The law mandates the formation of a Registration Committee responsible for receiving applications, issuing practising certificates, monitoring compliance with quality assurance standards and recommending disciplinary enquiries when necessary.

It also establishes the Insurance Institute of Kenya, governed by a council, as the lead professional organisation overseeing the conduct and standards of insurance practitioners.

It also mandates the Insurance Professionals Examinations Board will be responsible for administering professional examinations.

Kenya has moved to repair its dented credibility in fighting illicit financial flows after it was greylisted by a global money laundering and terrorism financing watchdog.

President William Ruto yesterday assented to the Anti-Money Laundering and Combating of Terrorism Financing Laws (Amendment) Bill, 2025, which is expected to strengthen Kenya’s framework for tackling money laundering, terrorism financing and proliferation financing.

Kenya was in February last year put on Finance Action Task Force’s (FATF) grey list after it failed to meet required threshold in its anti-money laundering and counter terrorism oversight, which made the country vulnerable to illicit financial flows.

Greylisting has far-reaching consequences, including local firms being unable to access international finance and trade opportunities, as well as losing foreign direct investments from global investors wary of pumping money into greylisted countries.

The enactment of the new law, State House said in a statement, represents a decisive step in bolstering the country’s financial system against illicit financial flows.

“The amended law seals long-standing loopholes that have enabled the misuse of property transactions and shell companies for illegal financial activities,” said the statement.

“These legal reforms reaffirm Kenya’s standing as a leader in financial integrity and enhance the country’s credibility in the global regulatory regime.”

Initially passed on April 16, 2025, the Bill was returned to Parliament by President Ruto with reservations. It was passed a second time by the National Assembly on June 3, 2025, with amendments that fully addressed the President’s concerns.

Ten Acts of Parliament have been amended to address technical compliance deficiencies flagged by the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) and the Financial Action Task Force (FATF).

The amended laws are: The Proceeds of Crime and Anti-Money Laundering Act (Cap. 59A); the Prevention of Terrorism Act (Cap. 59B); the Betting, Lotteries and Gaming Act (Cap. 131); the Retirement Benefits Act (Cap. 197); the Mining Act (Cap. 306); the Sacco Societies Act (Cap. 490B); the Accountants Act (Cap. 531); the Estate Agents Act (Cap. 533); the Certified Public Secretaries of Kenya Act (Cap. 534); and the Public Benefits Organizations Act (No. 18 of 2013).

The introduction of enhanced regulatory clarity and oversight in sectors such as real estate and mining is expected to boost investor confidence and attract foreign direct investment.

President Ruto also signed into law the Insurance Professionals Bill, which establishes a comprehensive legal framework to regulate the insurance industry, aimed at improving service standards, strengthening accountability and addressing professional misconduct in the sector.

The law mandates the formation of a Registration Committee responsible for receiving applications, issuing practising certificates, monitoring compliance with quality assurance standards and recommending disciplinary enquiries when necessary.

It also establishes the Insurance Institute of Kenya, governed by a council, as the lead professional organisation overseeing the conduct and standards of insurance practitioners.

It also mandates the Insurance Professionals Examinations Board will be responsible for administering professional examinations.

Stay informed. Subscribe to our newsletter

By Macharia Kamau