President William Ruto has renewed calls for reforms of the international financial system, warning that Africa’s debt burden and shrinking fiscal space are undermining both climate and development action.

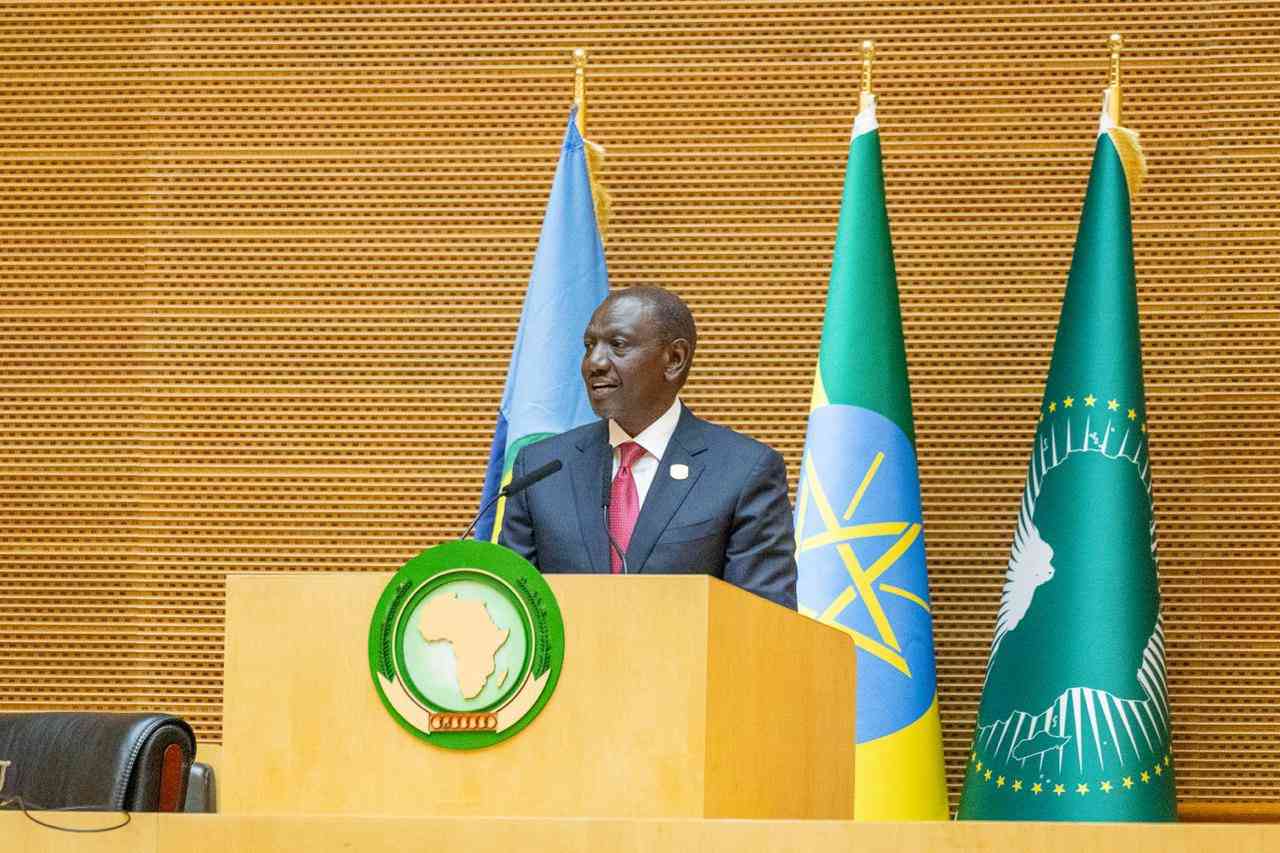

Speaking at the second Africa Climate Summit in Addis Ababa, Ruto said that despite commitments made at the inaugural summit in Nairobi in 2023, progress in practice remains minimal, leaving many African countries trapped in debt distress.

“Today, at least 21 African countries are in or at high risk of debt distress. Fiscal space is limited, debt servicing is high, and both development and climate finance flows are offset by these costs,” said Ruto.

The president noted, African governments spend 13.5 per cent of their budgets on debt repayment—far more than they allocate to critical sectors such as health and education. Additionally, wiith declining aid, shrinking fiscal space, and constrained access to capital markets, most African countries are unable to refinance sustainably.

Follow The Standard

channel

on WhatsApp

“These macroeconomic realities directly undermine climate and development action. Investment is deterred by currency volatility, limited convertibility, and high debt servicing,” he added.

Ruto emphasized that refinancing and restructuring must be placed at the center of the reform agenda, stressing that macroeconomic stability is the foundation of progress.

He said debt restructuring under the IMF’s Common Framework must be made fair, timely, and effective, warning that the current system often produces lengthy processes with little tangible relief for distressed countries.

In addition, he called for the replenishment of concessional windows such as the International Development Association (IDA) and the African Development Fund, describing them as lifelines for Africa and other developing regions whose resources are rapidly depleting.

The President also underscored the urgency of reforming multilateral development banks (MDBs), pointing out that balance sheet optimization alone cannot mobilize the trillions needed for climate and development.

While commending the African Development Bank’s recent issuance of hybrid capital, he insisted that MDB capital increases are essential for financing at scale.

Ruto further raised concern about the International Monetary Fund’s Resilience and Sustainability Facility (RSF), which channels Special Drawing Rights (SDRs) for climate action but remains tied to traditional program conditionalities.

He stressed that SDRs must serve people directly and not become “another instrument of procedure.”

On the energy front, he urged that IMF debt sustainability analyses should account for the unique financing needs of power sector reforms.

Without significant investment in reliable energy systems, he said, Africa’s aspirations for green industrialisation will remain a deferred dream.

Ruto added that unless the global financial architecture is reformed, climate finance commitments will remain “passionate rhetoric” without meaningful impact.

“This requires a united stand and a strong, collective voice from Africa, the Caribbean, and across the developing world. Only together can we ensure that the international financial system becomes an enabler of resilience and prosperity, rather than a structural barrier,” he said.

Follow The Standard

channel

on WhatsApp

President William Ruto has renewed calls for reforms of the international financial system, warning that Africa’s debt burden and shrinking fiscal space are undermining both climate and development action.

Speaking at the second Africa Climate Summit in Addis Ababa, Ruto said that despite commitments made at the inaugural summit in Nairobi in 2023, progress in practice remains minimal, leaving many African countries trapped in debt distress.

“Today, at least 21 African countries are in or at high risk of debt distress. Fiscal space is limited, debt servicing is high, and both development and climate finance flows are offset by these costs,” said Ruto.

The president noted, African governments spend 13.5 per cent of their budgets on debt repayment—far more than they allocate to critical sectors such as health and education. Additionally, wiith declining aid, shrinking fiscal space, and constrained access to capital markets, most African countries are unable to refinance sustainably.

Follow The Standard

channel

on WhatsApp

“These macroeconomic realities directly undermine climate and development action. Investment is deterred by currency volatility, limited convertibility, and high debt servicing,” he added.

Ruto emphasized that refinancing and restructuring must be placed at the center of the reform agenda, stressing that macroeconomic stability is the foundation of progress.

He said debt restructuring under the IMF’s Common Framework must be made fair, timely, and effective, warning that the current system often produces lengthy processes with little tangible relief for distressed countries.

In addition, he called for the replenishment of concessional windows such as the International Development Association (IDA) and the African Development Fund, describing them as lifelines for Africa and other developing regions whose resources are rapidly depleting.

The President also underscored the urgency of reforming multilateral development banks (MDBs), pointing out that balance sheet optimization alone cannot mobilize the trillions needed for climate and development.

While commending the African Development Bank’s recent issuance of hybrid capital, he insisted that MDB capital increases are essential for financing at scale.

Ruto further raised concern about the International Monetary Fund’s Resilience and Sustainability Facility (RSF), which channels Special Drawing Rights (SDRs) for climate action but remains tied to traditional program conditionalities.

He stressed that SDRs must serve people directly and not become “another instrument of procedure.”

On the energy front, he urged that IMF debt sustainability analyses should account for the unique financing needs of power sector reforms.

Without significant investment in reliable energy systems, he said, Africa’s aspirations for green industrialisation will remain a deferred dream.

Ruto added that unless the global financial architecture is reformed, climate finance commitments will remain “passionate rhetoric” without meaningful impact.

Stay informed. Subscribe to our newsletter

“This requires a united stand and a strong, collective voice from Africa, the Caribbean, and across the developing world. Only together can we ensure that the international financial system becomes an enabler of resilience and prosperity, rather than a structural barrier,” he said.

Follow The Standard

channel

on WhatsApp

By Sharon Wanga