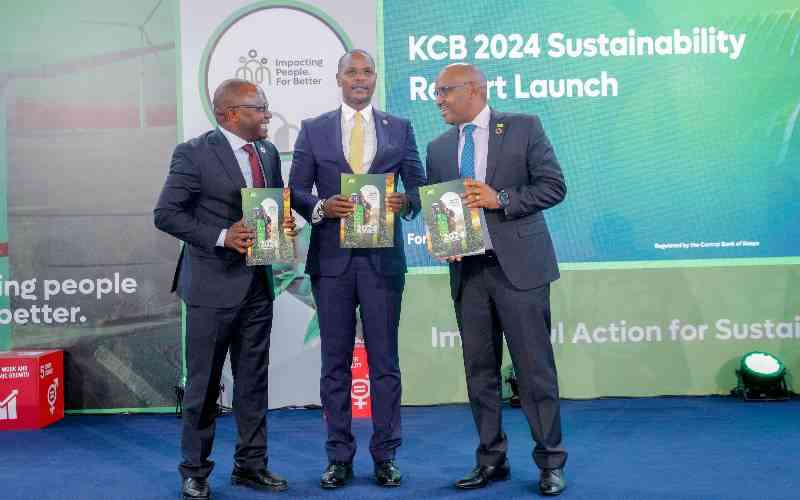

Kenya’s largest bank by assets said green loans now constitute 21.32 per cent of its total portfolio, edging closer to its 2025 target of 25 per cent, according to its 2024 Sustainability Report launched on Tuesday.

The shift highlights a strategic pivot for one of East Africa’s largest lenders, reflecting a broader trend where local and regional financial institutions are increasingly aligning their operations with global climate goals amid investor and regulatory pressure.

Green finance, a core component of this strategy, involves lending and investments that support “environmental benefits.”

For KCB, this has translated into funding for renewable energy, climate-smart agriculture, green buildings, and clean transportation, moving capital away from carbon-intensive sectors, said the lender.

Follow The Standard

channel

on WhatsApp

“The substantial growth of our green finance portfolio reflects our commitment to aligning our business with climate action and sustainable economic development,” Group Chief Executive Officer Paul Russo said in the report.

The push is part of the global trend where banks are under growing scrutiny to manage climate-related risks and support the transition to a low-carbon economy.

KCB’s commitment mirrors actions by global peers and aligns with frameworks like the Net-Zero Banking Alliance, which it has joined.

The report revealed that the group screened a massive Sh578.3 billion in loan facilities for environmental and social risks in 2024.

A key milestone, the lender said, was KCB Bank Kenya securing a project preparation facility from the Green Climate Fund (GCF), unlocking $540,000 (Sh70.2 million) to develop a full funding proposal for green MSMEs—a first for an East African financial institution.

This is part of a broader effort to secure $118.2 million (Sh15.37 billion) in international climate capital.

Environment and Climate Change Principal Secretary Festus Ng’eno said the financial sector is an enabler of human progress.

“In today‘s context, it has become much more than capital flow, it is a lifeline for sustainable households. When thoughtfully directed, finance can help farmers adopt climate-smart agriculture, empower small and medium enterprises to scale, enable women and youth unlock their entrepreneurial potential, and catalyse innovation in renewable energy and green infrastructure,” Dr Ng’eno said.

Beyond lending, KCB’s environmental stewardship includes a landmark afforestation drive. Its “Linda Miti” initiative saw 1.38 million trees planted in 2024 through partnerships with 1,259 schools, creating a tangible carbon sink and promoting biodiversity.

The sustainability drive is being replicated by its subsidiaries. KCB Bank Uganda planted 10,000 trees, while BPR Bank Rwanda Plc screened Sh5.3 billion in loans for ESG compliance.

In Tanzania, the bank expanded its branch network to 18 to improve rural financial inclusion, a key social sustainability metric.

KCB’s intensified focus has garnered industry recognition, including the Best Sustainable Bank in Kenya award.

As African nations face acute climate vulnerabilities, from drought to flooding, the strategic pivot by the region’s banking heavyweight offers a template for integrating climate resilience into the core of financial services, the bank’s officials suggested at the launch of the report.

Follow The Standard

channel

on WhatsApp

Kenya’s largest bank by assets said green loans now constitute 21.32 per cent of its total portfolio, edging closer to its 2025 target of 25 per cent, according to its 2024 Sustainability Report launched on

Tuesday

.

The shift highlights

a strategic pivot for one of East Africa’s largest lenders, reflecting a broader trend where local and regional financial institutions are increasingly aligning their operations with global climate goals amid investor and regulatory pressure.

Green finance, a core component of this strategy, involves lending and investments that support “environmental benefits.”

For KCB, this has translated into funding for renewable energy, climate-smart agriculture, green buildings, and clean transportation, moving capital away from carbon-intensive sectors, said the lender.

Follow The Standard

channel

on WhatsApp

“The substantial growth of our green finance portfolio reflects our commitment to aligning our business with climate action and sustainable economic development,” Group Chief Executive Officer Paul Russo said in the report.

The push is part of the global trend where banks are under growing scrutiny to manage climate-related risks and support the transition to a low-carbon economy.

KCB’s commitment mirrors actions by global peers and aligns with frameworks like the Net-Zero Banking Alliance, which it has joined.

The report revealed that the group screened a massive Sh578.3 billion in loan facilities for environmental and social risks in 2024.

A key milestone, the lender said, was KCB Bank Kenya securing a project preparation facility from the Green Climate Fund (GCF), unlocking $540,000 (Sh70.2 million) to develop a full funding proposal for green MSMEs—a first for an East African financial institution.

This is part of a

broader effort to secure $118.2 million (Sh15.37 billion) in international climate capital.

Environment and Climate Change Principal Secretary Festus Ng’eno said the financial sector is an enabler of human progress.

“In

today

‘s context, it has become much more than capital flow, it is a lifeline for sustainable households. When thoughtfully directed, finance can help farmers adopt climate-smart agriculture, empower small and medium enterprises to scale, enable women and youth unlock their entrepreneurial potential, and catalyse innovation in renewable energy and green infrastructure,” Dr Ng’eno said.

Beyond lending, KCB’s environmental stewardship includes a landmark afforestation drive. Its “Linda Miti” initiative saw 1.38 million trees planted in 2024 through partnerships with 1,259 schools, creating a tangible carbon sink and promoting biodiversity.

The sustainability drive is being replicated by its subsidiaries. KCB Bank Uganda planted 10,000 trees, while BPR Bank Rwanda Plc screened Sh5.3 billion in loans for ESG compliance.

In Tanzania, the bank

expanded its branch network to 18 to improve rural financial inclusion, a key social sustainability metric.

Stay informed. Subscribe to our newsletter

KCB’s intensified focus has garnered industry recognition, including the Best Sustainable Bank in Kenya award.

As African nations face acute climate vulnerabilities, from drought to flooding, the strategic pivot by the region’s banking heavyweight offers a template for integrating climate resilience into the core of financial services, the bank’s officials suggested at the launch of the report.

Follow The Standard

channel

on WhatsApp

By Brian Ngugi