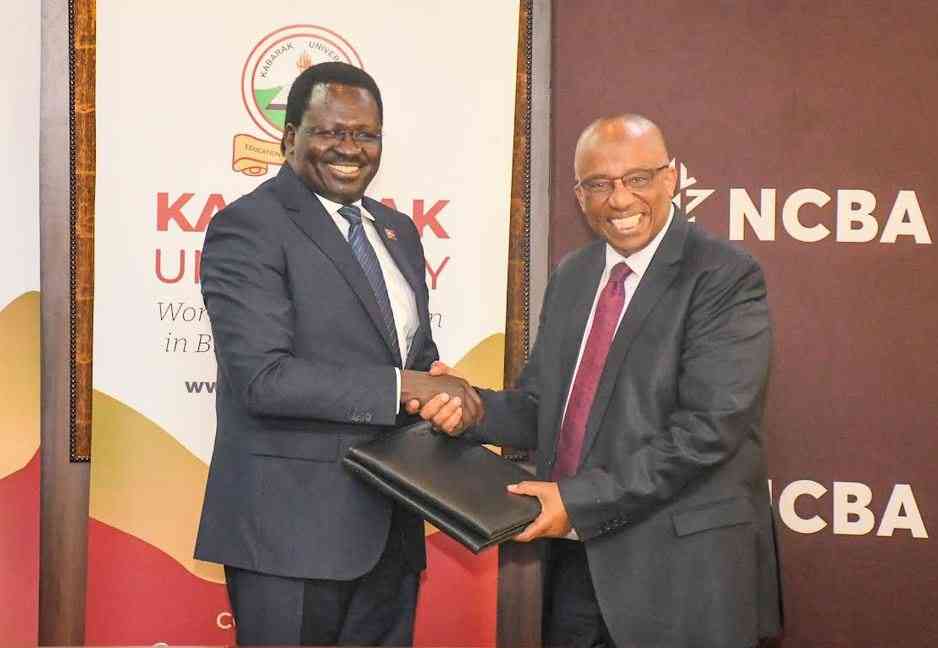

Kabarak University has entered into a partnership with NCBA Bank to strengthen the growth and sustainability of Small and Medium-sized Enterprises (SMEs) in the country.

Speaking during the launch of the Business Development Programme, Kabarak University Vice-Chancellor Professor Henry Kiplagat said the institution is not only focused on training students but also committed to empowering the community.

Prof Kiplagat noted that the partnership directly supports Kenya’s development agenda by strengthening SMEs, which employ millions of people and contribute significantly to the Gross Domestic Product (GDP).

“Entrepreneurs need more than just credit facilities. This collaboration will provide capacity-building programmes, financial literacy training, strategic business insights, and a holistic support ecosystem for SMEs,” he said.

Follow The Standard

channel

on WhatsApp

He described the Memorandum of Understanding (MoU) between the university and NCBA as a realisation of Kabarak’s community outreach mandate.

“What we need to do is improve the capacity of SMEs so that they become knowledgeable in managing their enterprises,” said Kiplagat.

He added that neither universities nor industries can work in isolation in a rapidly changing world.

“It is through collaboration that we generate the knowledge, innovation, and skills needed to power our nation’s economic growth,” he said.

The Vice-Chancellor observed that many businesses collapse after the demise of their founders. The new programme, he said, will equip entrepreneurs with knowledge on succession planning to ensure sustainability.

“For any business to thrive, management must be prudent. Management is not something one is born with; one has to learn and acquire the necessary skills. That is what we want SMEs to achieve, and that will be our great achievement as an institution,” he said.

He added that business owners will be trained on emerging technologies, including the use of Artificial Intelligence (AI) in business management.

“As a university, we are concerned with solving problems facing our communities. If mismanagement is one of the challenges affecting SMEs, then our role is to help address it by introducing prudent business management that leads to growth,” he said.

NCBA Bank Director for Commercial and SME Banking, Robert Kiboti, said the partnership seeks to address the knowledge gaps that hinder SME growth.

He said one of the challenges they have realised with SMEs is a lack of knowledge and market understanding.

The best way to bridge that gap is through partnerships with like-minded institutions such as Kabarak University. As a bank, we have noted gaps within SMEs while recognizing their critical role in the economy — both in GDP contribution and job creation,” said Kiboti.

He added that the programme, which has been piloted in other institutions, has yielded positive results.

“We expect that once entrepreneurs are trained, they will acquire better management skills and improve governance. With stronger governance, SMEs will be able to exist beyond their founders,” Kiboti said.

He emphasized that improved SME performance translates to better household incomes, scalability, and increased employment — all of which contribute positively to the country’s economy.

Follow The Standard

channel

on WhatsApp

Kabarak University has entered into a partnership with NCBA Bank to strengthen the growth and sustainability of Small and Medium-sized Enterprises (SMEs) in the country.

Speaking during the launch of the Business Development Programme, Kabarak University Vice-Chancellor Professor Henry Kiplagat said the institution is not only focused on training students but also committed to empowering the community.

Prof Kiplagat noted that the partnership directly supports Kenya’s development agenda by strengthening SMEs, which employ millions of people and contribute significantly to the Gross Domestic Product (GDP).

“Entrepreneurs need more than just credit facilities. This collaboration will provide capacity-building programmes, financial literacy training, strategic business insights, and a holistic support ecosystem for SMEs,” he said.

Follow The Standard

channel

on WhatsApp

He described the Memorandum of Understanding (MoU) between the university and NCBA as a realisation of Kabarak’s community outreach mandate.

“What we need to do is improve the capacity of SMEs so that they become knowledgeable in managing their enterprises,” said Kiplagat.

He added that neither universities nor industries can work in isolation in a rapidly changing world.

“It is through collaboration that we generate the knowledge, innovation, and skills needed to power our nation’s economic growth,” he said.

The Vice-Chancellor observed that many businesses collapse after the demise of their founders. The new programme, he said, will equip entrepreneurs with knowledge on succession planning to ensure sustainability.

“For any business to thrive, management must be prudent. Management is not something one is born with; one has to learn and acquire the necessary skills. That is what we want SMEs to achieve, and that will be our great achievement as an institution,” he said.

He added that business owners will be trained on emerging technologies, including the use of Artificial Intelligence (AI) in business management.

“As a university, we are concerned with solving problems facing our communities. If mismanagement is one of the challenges affecting SMEs, then our role is to help address it by introducing prudent business management that leads to growth,” he said.

NCBA Bank Director for Commercial and SME Banking, Robert Kiboti, said the partnership seeks to address the knowledge gaps that hinder SME growth.

He said one of the challenges they have realised with SMEs is a lack of knowledge and market understanding.

The best way to bridge that gap is through partnerships with like-minded institutions such as Kabarak University. As a bank, we have noted gaps within SMEs while recognizing their critical role in the economy — both in GDP contribution and job creation,” said Kiboti.

Stay informed. Subscribe to our newsletter

He added that the programme, which has been piloted in other institutions, has yielded positive results.

“We expect that once entrepreneurs are trained, they will acquire better management skills and improve governance. With stronger governance, SMEs will be able to exist beyond their founders,” Kiboti said.

He emphasized that improved SME performance translates to better household incomes, scalability, and increased employment — all of which contribute positively to the country’s economy.

Follow The Standard

channel

on WhatsApp

By Julius Chepkwony