The Central Bank of Kenya (CBK) has dismissed commercial lenders’ claims that its proposed loan pricing reforms amount to a return to “interest rate capping,” escalating a deepening rift over President William Ruto’s push for cheaper credit.

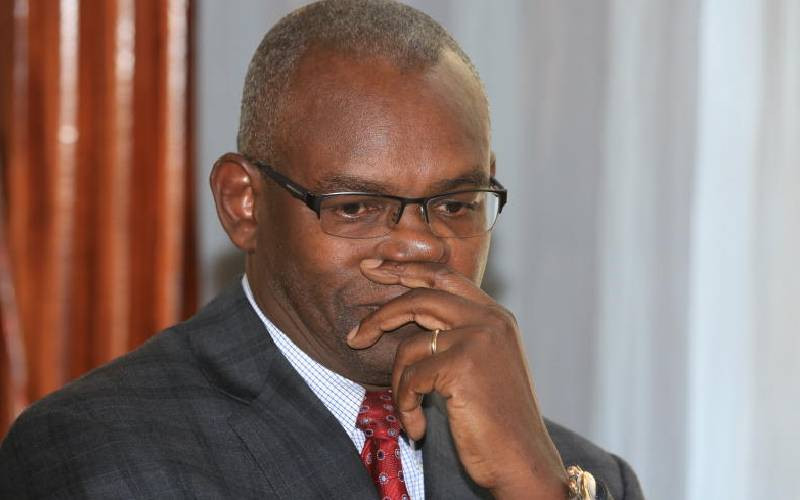

Governor Kamau Thugge, in a robust response to the Kenya Bankers Association (KBA), reiterated the regulator’s commitment to a “transparent and efficient credit market,” while rejecting the banks’ concerns as unfounded.

Get Trusted News for Only Ksh99 a Week

Subscribe Today & Save!

Get Started

Unlimited access to all premium content

Uninterrupted ad-free browsing experience

Mobile-optimized reading experience

Weekly Newsletters

Already a subscriber? Log in

The Central Bank of Kenya (CBK) has dismissed commercial lenders’ claims that its proposed loan pricing reforms amount to a return to “interest rate capping,” escalating a deepening rift over President William Ruto’s push for cheaper credit.

By Brian Ngugi