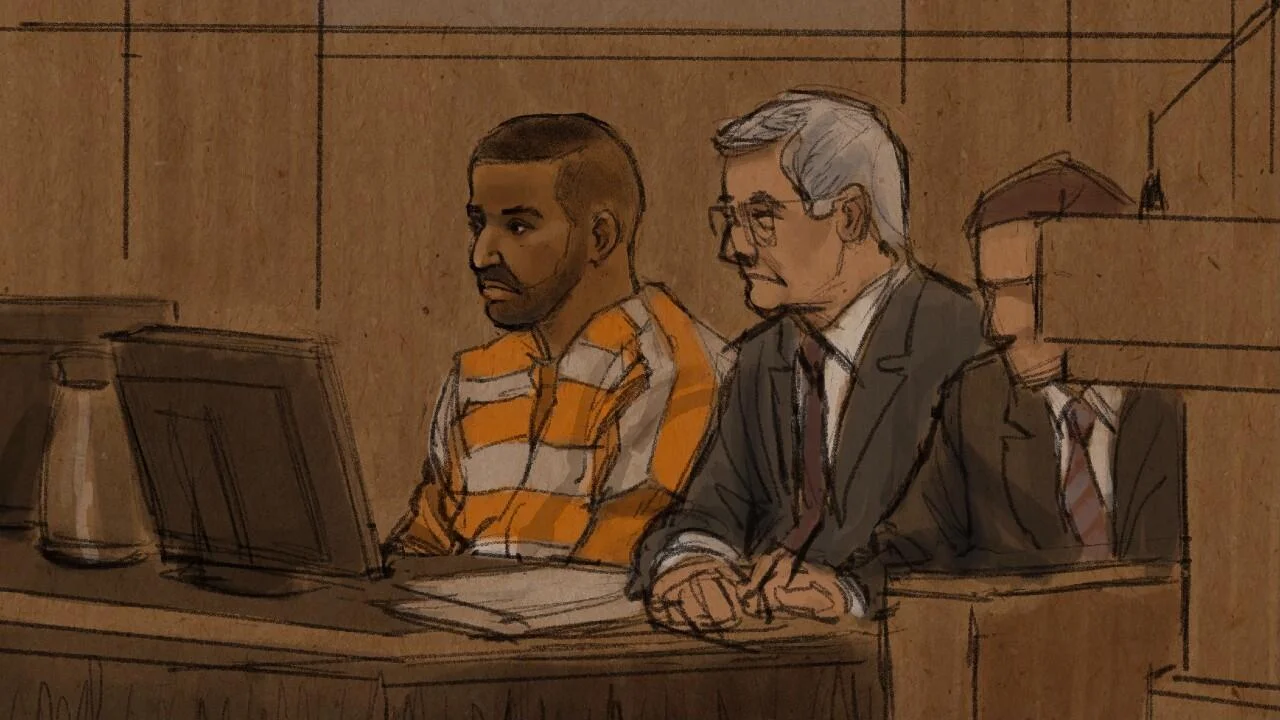

In early August, Abdiaziz Farah, a 36-year-old Somali-American businessman, was sentenced to 28 years following his involvement in a US$300 million fraud scheme that exploited the Feeding Our Future program, a US federal child nutrition initiative meant to feed vulnerable children.

Farah, who fled war-torn Somalia and spent his early childhood in a Kenyan refugee camp, built a life that many would describe as the American dream: garnering college degrees, small business ownership, and community involvement.When the COVID-19 pandemic struck, Farah, who was the co-owner of a restaurant called Empire Cuisine & Market, saw an opportunity to pilfer millions of dollars alongside many accomplices by falsely claiming to serve 18 million meals across over 30 sites.Many of these sites were empty commercial spaces or parking lots, and the scheme included phony meal counts and invoices listing fabricated children’s names.

“As presented at trial, Farah sent text messages to his co-defendants about their ill-gotten gains, stating “in 7 months if things stay the same you are a multi millionaire with 0 debt” and “Bro the next multi legit millionaires will be me and you,” U.S. Attorney’s Office, District of Minnesota said in a statement in early August.

Farah pocketed more than US$8 million, spending it on luxury cars, real estate in the Twin Cities and Kentucky, and overseas properties, including a high-rise apartment in Nairobi, Kenya. He also bought five luxury vehicles in about six months, including spending over $300,000 for a Porsche, a GMC truck, and a Tesla.

According to investigators, he also directed the flow of illicit funds to co-conspirators and maintained the operation through a corrupt pay-to-play system, providing bribes and kickbacks to the program’s personnel.

Farah’s misconduct extended internationally, with portions of the stolen funds laundered through China and invested in assets beyond the reach of U.S. law enforcement. His attempt to flee to Kenya in 2022 using a falsified passport was thwarted, and he later pleaded guilty to charges of attempting to bribe a juror in the case.

In mid-June 2024, Farah and several others attempted to bribe a juror in the case with US$120, 000 to sway the verdict, triggering a second case.

The Family Fraud

Farah’s conspiracy extended to his family members, exposing an intricate web of money laundering. Prosecutors say Farah’s younger brother, a Kenyan national named Ahmednaji Maalim Aftin Sheikh, helped move millions of stolen funds in Kenya, including the purchase of an apartment complex in Nairobi’s South C and land in Mandera. Sheikh was indicted in early September.

Another brother, Abdulkarim Farah, admitted to driving and filming the US$120,000 cash drop in the failed attempt to bribe a juror in Farah’s case. A third brother, Said Farah, also pleaded guilty in the bribery scheme after earlier beating fraud charges. Farah’s sister-in-law allegedly lived in a home purchased with fraud proceeds before marrying Sheikh in Nairobi and later filing to sponsor his immigration.

Another key defendant in the case, Liban Alishire, admitted to siphoning nearly US$1.8 million from the program by inventing meal counts by using his Lake Street Kitchen and Community Enhancement Services as fraudulent food distribution fronts. U.S Prosecutors said he claimed to have served 870,000 meals in less than a year, then routed the stolen funds through shell companies for personal gain.

As part of his plea deal, Alishire agreed to forfeit assets including a Nairobi apartment, a property at the Karibu Palms Resort near Mombasa, a boat, a trailer, and a Ford F-150 pickup. The deal required Alishire to pay US$712,084 in restitution and could see him serve between 41 and 51 months in prison.

Mohamed Jama Ismail, a co-owner of Empire Cuisine & Market, was also found guilty of conspiracy to commit wire fraud and money laundering after pocketing more than US$2 million of the funds. U.S Authorities said he spent the proceeds on vehicles and mortgage payments before attempting to board a one-way flight to Kenya with a new passport he obtained by falsely claiming his old one was lost.

Meanwhile, three members of the Jama family — Zamzam, Mustafa, and Asha — laundered millions through shell firms and restaurants, channeling stolen nutrition funds into homes in Minnesota, Ohio, and even coastal property in Turkey.

Unravelling the Web

Abdimajid Mohamed Nur was only 20 when he joined the program. He was also convicted on multiple counts of wire fraud and money laundering. Prosecutors said he laundered stolen taxpayer money through a consulting firm that funneled cash into international transfers, jewelry purchases, and debt payments.

Another key conspirator in the fraud was Aimee Bock, who was the executive director of the Feeding Our Future program. Bock facilitated the fraudulent operations by enrolling numerous meal sites that claimed to serve meals but instead funneled funds into personal luxuries. She was convicted on multiple charges including wire fraud and conspiracy. Alongside her conviction was Salim Said’s, a close associate of Bock who aided in the misrepresentation of meal counts and the diversion of funds.

U.S prosecutors have also marked Muna Wais Fidhin, 44, who pocketed roughly US$1 million after falsely claiming to serve more than 300,000 meals through her companies, M5 Café and M5 Care. Instead of feeding children, she was accused of using the funds to pay off her mortgage, buy a car, fund her lifestyle, and wire tens of thousands abroad.

Abduljabar Hussein and his wife, Mekfira, collected US$8.8 million through fraudulent invoices tied to their nonprofit and vendor company, spending proceeds on luxury cars and mortgage payments.

Another defendant, Abdinasir Abshir, pleaded guilty to wire fraud and was accused of witness tampering during the trial of Aimee Bock. He and his brother made fraudulent claims of providing meals to children, collecting US$5.4 million, and engaging in bribery.

Hadith Yusuf Ahmed, who monitored food sites enrolled in the federal feeding program, admitted to accepting US$1 million in kickbacks. Others who received money from the scheme without providing the meals include Abdihakim Ali Ahmed and Bekam Merdassa.

Kenya is on the Money Laundering Gray Lists

According to the U.S Department of State, Kenya’s battle against money laundering is being undercut by lawyers, real estate agents, who operate in a regulatory gray zone. These professionals are accused of abetting the flow of illicit cash tied to narcotics, wildlife trafficking, and corruption.

Despite a 2023 pact between the Law Society of Kenya and the Financial Reporting Centre, a court ruling shielding attorney-client privilege has left a gaping loophole.

Meanwhile, thriving informal Somali financial networks built on trust and cultural ties, facilitate swift, anonymous cross-border transactions and continue to channel untraceable funds across the Kenyan borders.

With Kenya still on the Financial Action Task Force’s grey list, enforcement lags and the booming but under-supervised real estate sector risk turning the country’s aspirations of becoming a regional financial hub into yet another front for global illicit finance.